- Apply

Until - Apr 15

- Minimum

amount - Price Per

Share - Current

Valuation

This investment has already started. Check out our current offerings in the “Invest Now” section!

Invest in the secure and efficient chatbot Claude, which beats ChatGPT on a number of key metrics.

Important disclosure

*We are finalizing the price and valuation terms of the deal. The implied valuation of the deal is a preliminary estimate as it reflects the current market price of the offer.

Why Invest in Anthropic?

-

Anthropic has developed the best-performing large language model (Opus) that outperforms ChatGPT and Gemini 1 Ultra in a number of key metrics.

-

Opus is already being used in fintech, biotech, big data and other industries that require cutting-edge performance for tasks like complex data analysis and biomedical research.

-

Anthropic's 2024 revenue could reach $1B, The Information reports. That's a tenfold increase from last year.

-

The company is led by top AI talent with a proven track record of building advanced AI systems.

-

Anthropic's development of reliable and interpretable AI systems addresses growing concerns about the ethical and social implications of AI.

-

Anthropic is focusing on business customers. Focusing on serving large enterprises and “startups making bold technological bets” positions it for long-term growth and profitability.

What is Anthropic?

Anthropic is an AI company founded in 2021 by ex-OpenAI employees, including Dario Amodei, former VP of Research and Tom Brown, former lead engineer for AI language model GPT-3. In March 2024 Anthropic released Claude 3 Opus, which the company claims beats OpenAI’s GPT-4 and Google’s Gemini 1 Ultra in key metrics. Here is the benchmark matrix shared by Anthropic:

Recognizing the profound influence that AI is poised to have on the world, Anthropic is committed to designing systems that are dependable, transparent, and controllable. The company is focused on AI safety and research, exploring both the potential benefits and potential risks of AI.

The three versions of Claude 3 – Opus, Sonnet and Haiku – vary in performance and price. According to Anthropic's CEO, the Claude 3 Opus, the most powerful and expensive version, is “in many respects the best-performing model in the world across a range of tasks.”

Productivity software maker Asana found a 42% improvement in initial response time. Fellow software company Airtable said it has integrated Claude 3 Sonnet into its own AI tool to speed up content creation and data summarisation.

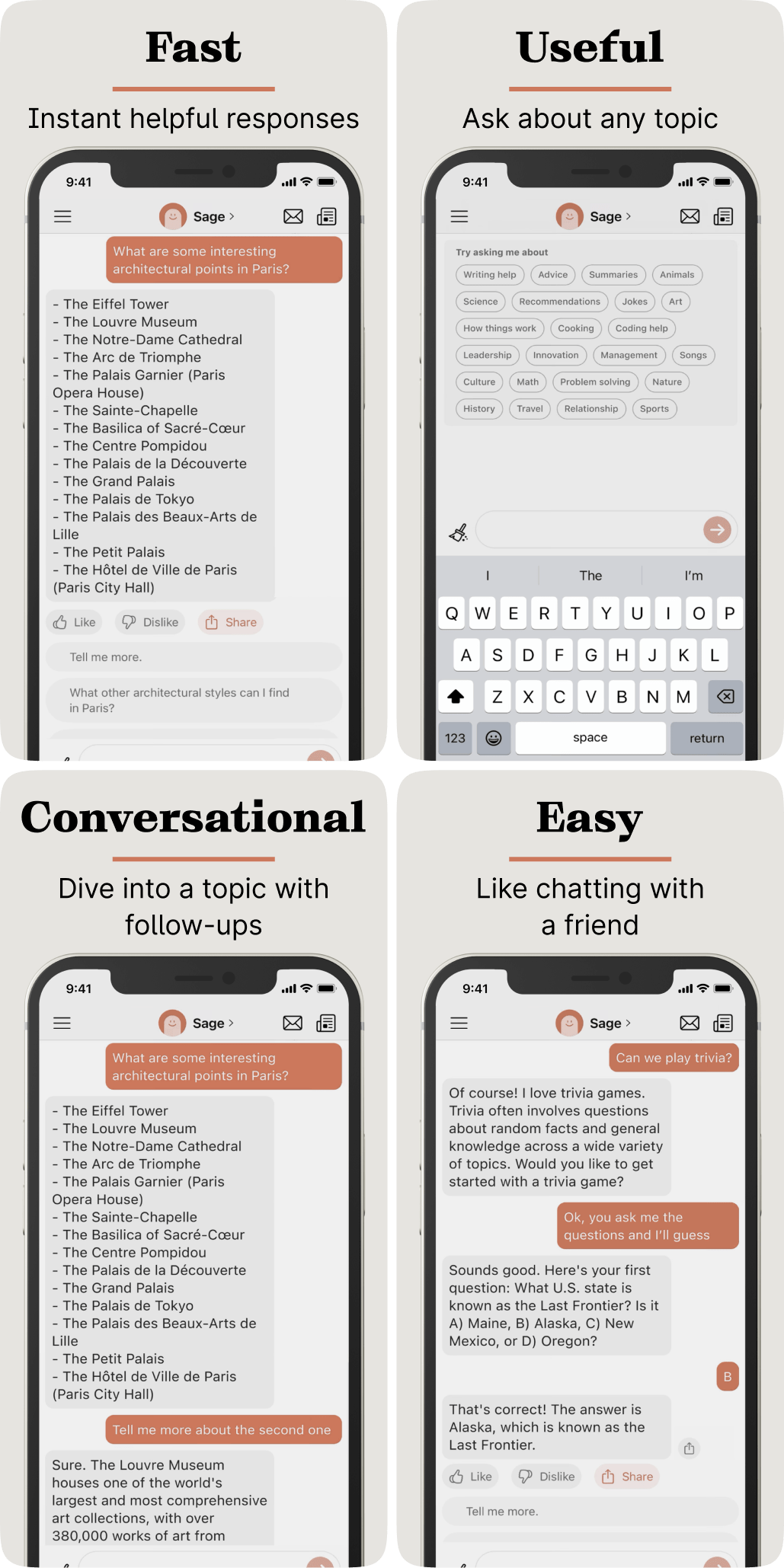

Product

Similar to ChatGPT, Anthropic's Claude is a large language model that can be used for a range of written tasks like summarizing, searching, answering questions and coding. The company is positioning its chatbot as more cautious from the start. It’s meant to be harder to wring offensive results from it. Thanks to its ethical approach and its ability to produce reliable and secure results, Claude is emerging as one of the most promising chatbots on the market.

Anthropic has already provided its technology to a number of companies, including SAP, Bridgewater, Asana, Gitlab, Slack, Notion, Quora, DuckDuckGo, Robin AI, and AssemblyAI (Claude supports its audio data transcription and comprehension API platform).

According to Autumn Besselman, Head of People and Communications at Quora, users appreciate Claude's detailed and understandable responses and the natural feel of their conversations. Users have described Claude as more interactive and creative in storytelling than ChatGPT, and they appreciate the combination of language skills and expertise in Claude's responses.

Akshay Kothari, Notion's Co-Founder and COO, stated that the partnership's goal is to help users enhance their productivity using AI. Claude's exceptional creative writing and summarization capabilities contribute to Notion AI, their connected AI assistant. With this integration, Notion users can enhance their writing skills and work more efficiently.

Robin AI, a legal infrastructure company, is using Claude to revolutionize contracts. According to Robin AI CEO Richard Robinson, Claude is proficient in interpreting legal language and proposing customer-friendly alternatives. The technology's drafting, summarizing, and translation capabilities are exemplary. Since integrating Claude, Robin AI has observed increased user engagement, better feedback, and more successful deals.

Market

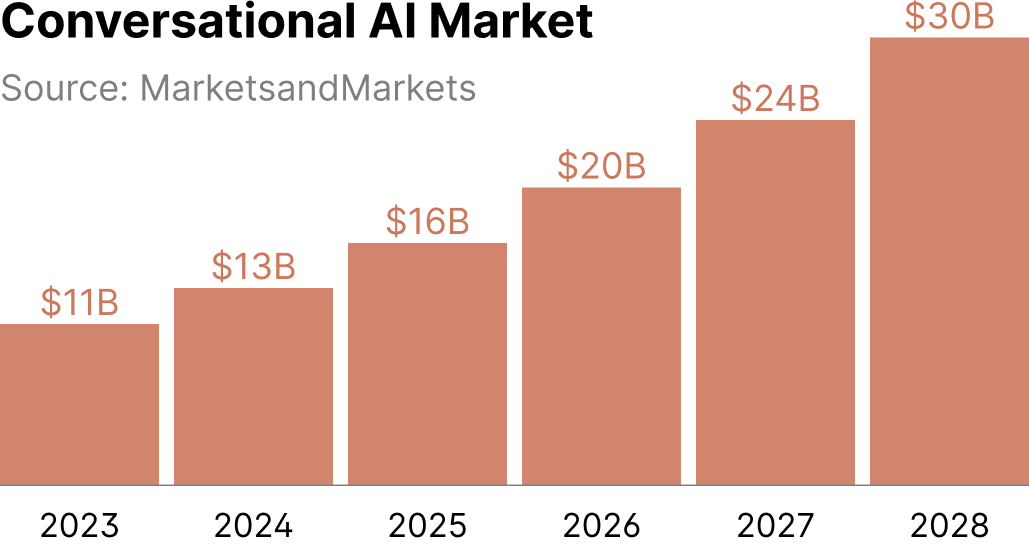

The AI market is expected to grow rapidly in the coming years, with increasing demand for AI-powered solutions across industries. The growth will be driven by a variety of factors, including advancements in deep learning and natural language processing technologies.

According to Zion Market Research, the global market for AI is projected to increase from $60B in 2021 to $422B by 2028 with an impressive compound annual growth rate (CAGR) of 39.4% during the period. The conversational systems market is expected to triple in size by 2028.

Financials

Anthropic has raised a total of $7.6B from a variety of investors, including Google, Amazon, Menlo Ventures, Jaan Tallinn, James McClave, Dustin Moskovitz, Salesforce Ventures, and Spark Ventures. The latest financing round in December 2023 valued the company at $17B, equivalent to $30 per share. As of now, the company is valued at $20B on the secondary market.

In September 2023, the company informed some investors that it was operating at a $100M annualized revenue rate and anticipated reaching $500M by the end of 2024, as reported. As of December 2023, Anthropic projected it would generate over $850M in annualized revenue by the end of 2024.

Anthropic increased its initial estimate by nearly 70% within three months, indicating stellar growth. The company’s 2024 revenue could reach $1B, The Information reports. That's a tenfold increase from last year.

Team

Dario Amodei has an impressive background in AI research and development. As the former Vice President of Research at OpenAI, he led the development of GPT-2 and GPT-3, spearheaded safety research aimed at making AI systems more transparent and aligned with human values. Prior to his time at OpenAI, Dario worked as a deep learning researcher on the Google Brain team. Dario's academic background includes a PhD in physics from Princeton University, where he focused on statistical mechanics models of neural circuits and developed new devices for intracellular and extracellular recording. He also served as a postdoctoral scholar at Stanford University School of Medicine, where he worked on searching for cancer biomarkers.

Anthropic's team includes other top AI talent from OpenAI, including Tom Brown, lead engineer for AI language model GPT-3, and OpenAI's former policy lead Jack Clark.

Risks

General risks of investing in private companies

Company-specific risks

Competition. The market for AI solutions is highly competitive and has a number of players, including OpenAI (ChatGPT), Cohere, Adept AI, Inflection, Hugging Face. This could impact Anthropic's market position and profitability.

Market overvaluation. Due to current hype, there is a risk that the company's valuation has currently outgrown its pace of product development.

Offering

Deal Structure

Dizraptor Fund 1050 LLC is formed for the purpose of acquiring common shares of Anthropic. The interests in the fund are offered to accredited investors, who, after signing a subscription agreement, become its members.

Dizraptor always seeks the optimal ownership structure for its investors. In certain cases, when direct ownership of shares is unavailable due to restrictions of a private company, Dizraptor fund will consider alternative ways of equity exposure, such as double or multiple-layer SPV partnerships or forward agreements. In this case, Dizraptor's investors will have indirect access to Anthropic.

View SPV’s Documents

Limited Liability Company Agreement (pdf)

Confidential Private Placement Memorandum (pdf)

Subscription Agreement & Privacy Notice (pdf)

Investment Management Agreement (pdf)

Fees

Fee on management – 5%, paid on top of the investment amount.

Carried interest – 20% of net profit. Charged at the closing of investment, after the rest of the commissions are paid.

Sources

AI Startup Anthropic Pursues $5B Investment for OpenAI Showdown — Report, EnterpriseAI, Apr 2023

Introducing Claude, www.anthropic.com, Mar 2023

Meet Claude: Anthropic’s Rival to ChatGPT, Scale.com, Jan 2023

Google invested $300 million in AI firm founded by former OpenAI researchers, The Verge, Feb 2023

Google-backed Anthropic launches Claude, an AI chatbot that’s easier to talk to, The Verge, Mar 2023

Anthropic launches Claude, a chatbot to rival OpenAI’s ChatGPT, TechCrunch, Mar 2023

Dario Amodei, PhD, Hertzfoundation.org

AI Unicorn Anthropic Releases Claude 3, A Model It Claims Can Beat OpenAI's Best, FORBES, Mar 2024

Anthropic forecasts more than $850 mln in annualized revenue rate by 2024-end, Reuters, Dec 2023