Plaid is a secure connection between consumers’ financial data and the apps they use every day. Invest in fintech with 500+ million user accounts!

Important disclosure

*We are finalizing the price and valuation terms of the deal. The implied valuation of the deal is a preliminary estimate as it reflects the current market price of the offer.

What Is Plaid?

Plaid makes it easy for consumers to securely connect their bank accounts and financial data to the apps they use every day through application programming interfaces (APIs). So Plaid acts as an intermediary between apps (like Robinhood or Coinbase) and banks so that users can log in and share data securely.

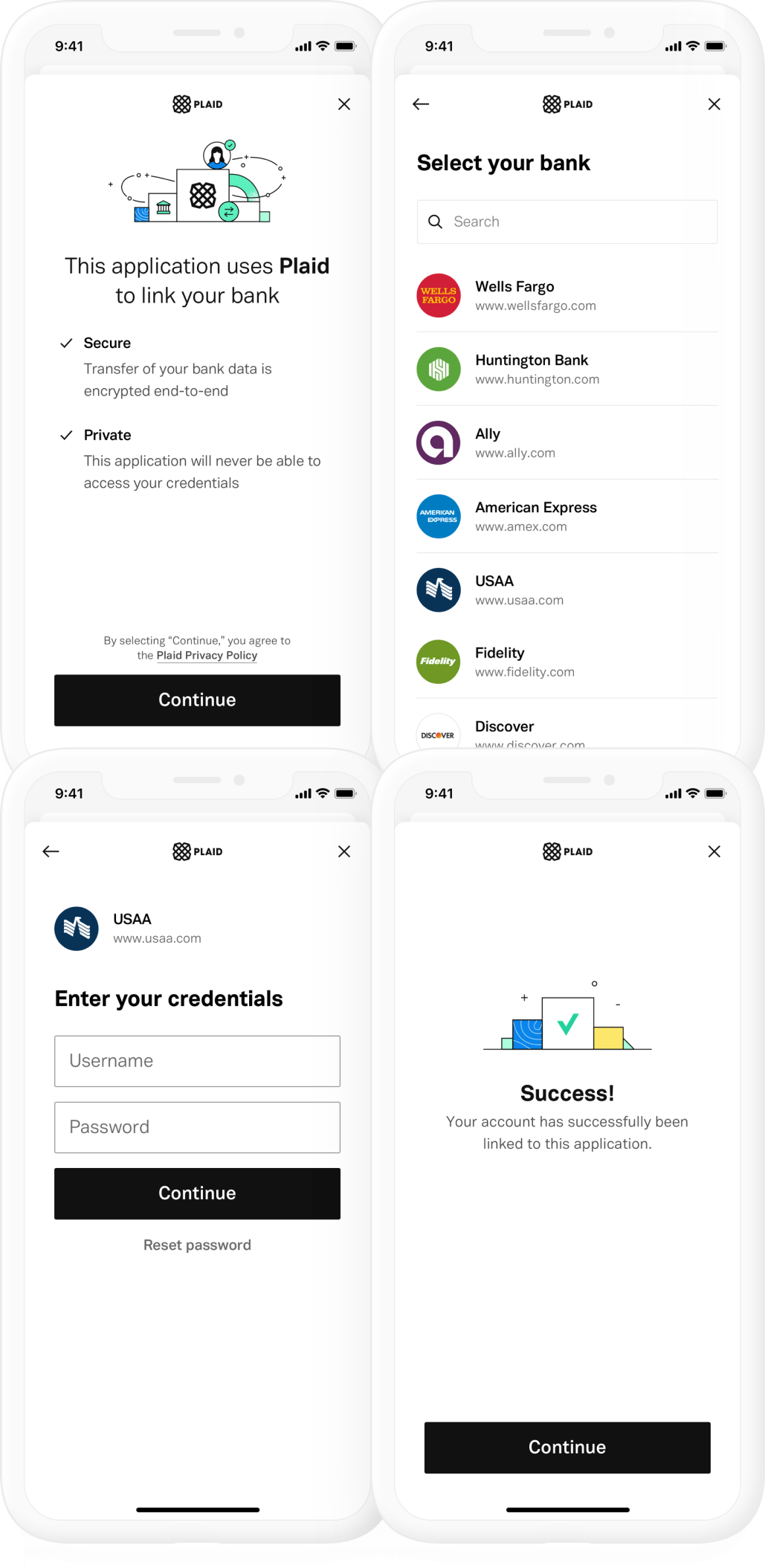

How Plaid Works

-

A consumer signs up in the financial app (e.g. Robinhood or Coinbase) and grants Plaid access to their financial accounts.

-

Plaid securely retrieves financial data through APIs from various financial institutions.

-

Plaid formats the data for use by financial management apps.

-

A consumer can now view their financial accounts through a preferred financial management app.

-

Plaid continuously monitors for changes and updates the financial data in real-time.

Ecosystem

The number of linked bank accounts has grown rapidly from 10 million in 2015 to over 500 million in 2022. Plaid is used by one in four people in the U.S. and Canada to connect their bank accounts to fintech apps.

Why Invest in Plaid?

International expansion ahead

Plaid fully operates in 11 countries including the US, Canada, Germany, UK, France, Spain, Ireland, Netherlands, Sweden, Denmark and Portugal.

Plaid intends to significantly expand its international presence. It is already expanding to Italy, Poland, Lithuania, Latvia, Estonia, Norway, Belgium, Austria and Finland. There are also significant expansion opportunities into the Middle East and Asia.

Leading position in the market

Plaid is the market leader with the most financial institution coverage and the biggest network of fintech and enterprise customers. This presents an important advantage for further scaling.

Leverage network effects

Non-financial firms are exploring ways to integrate financial services into their existing products. Plaid signed new enterprise clients, such as Microsoft and Google, in 2020, with additional major corporations anticipated.

Growing demand for fintech solutions

With the growing adoption of mobile banking and demand for speedy financial transactions, the utilization of API services like Plaid is experiencing a surge. The company is in a favorable position to capitalize on this trend.

Crypto and Web 3.0

In Oct 2022 Plaid launched Wallet Onboard, their first crypto product. It brings Plaid's account linking technology to Web 3.0 apps by enabling developers to integrate with over 300 wallets (e.g. MetaMask, Coinbase Wallet, Trust) for Ethereum blockchain-based apps. Users can connect their preferred wallet like they would a bank account. This marks the beginning of Plaid's plans to launch various Web 3.0 products.

Plaid operates with a freemium, allowing users to try its core products for free and upgrade to a paid plan with additional features if desired.

Plaid generates revenue in three ways:

-

One-time fee for connecting the app to the customer's bank account.

-

Per-request fee for transactions via Plaid (e.g. bank to Robinhood transfer). The majority of Plaid's income comes from this source of revenue.

-

Monthly subscription fee.

Market

Financial institutions are embracing open finance solutions as the global open finance market is expected to surge from $15B in 2021 to $48B in 2026. In 2020, it was estimated that only 20% of banks had adopted APIs for data management, a necessity driven by customer demand.

Plaid's market potential is growing as more non-financial companies seek direct access to consumers' bank accounts. This concept, called "embedded finance," allows every company to offer financial services. Plaid facilitates the flow of information between financial institutions and non-financial companies, and third-party providers.

A Plaid and Accenture report states that embedded financial services will generate $230B in revenue by 2025, a significant increase of 10 times over the $22.5B in revenue generated in 2020.

Plaid has raised a total of $815M in funding over 5 rounds from 21 investors including Andreessen Horowitz, Kleiner Perkins, Google Ventures, Goldman Sachs and others. The Series D funding round occurred shortly after the Department of Justice prevented Visa's acquisition of Plaid in November 2020, which was valued at $5.3B.

Risks

General risks of investing in private companies

Company-specific risks

Plaid has recently announced layoffs of 20% of its workforce. The fintech company states that it “hired and invested ahead of revenue growth.” If Plaid continues to underperform and miss the expectations, its valuation can decrease.

The competition is increasing. Startups offer alternatives for bank data access. Venice, for example, is creating a one-stop-shop aggregator that gathers data from various sources including Plaid and Yodlee through a single API, simplifying integration for fintechs. Front is developing APIs to obtain real-time investment data from brokers, exchanges, crypto-wallets, and custodians.

There is a growing popularity of payroll API firms such as Pinwheel and Argyle. Plaid's customers, such as Cash App, are now able to extract funds directly from their customers' payroll accounts instead of bank accounts, thus decreasing their reliance on Plaid.

Sources

Crunchbase.com/organization/plaid

"What does Plaid do?", Technically, Jan 2021

How Plaid is Quietly Building a Financial Data Empire, Joseph Hannon, Feb 2019

Plaid, Contrary Research, Jan 2023

What is embedded finance? 4 ways it will change fintech, Plaid.com, Oct 2022

Visa's Acquisition of Plaid, Jan 2020 (pdf)

Offering

Deal structure

Dizraptor Fund LLC is formed for the purpose of acquiring common shares of Plaid. The interests in the fund are offered to accredited investors, who, after signing a subscription agreement, become its members.

Dizraptor always seeks the optimal ownership structure for its investors. In certain cases, when direct ownership of shares is unavailable due to restrictions of a private company, Dizraptor fund will consider alternative ways of equity exposure, such as double or multiple-layer SPV partnerships or forward agreements. In this case, Dizraptor's investors will have indirect access to Plaid. In the case of a second or multiple-layer SPV, investors will have partnership units in a fund that has access to Plaid.

Fees

Management fee – 5%, paid on top of the investment amount.

Carried interest – 20% of net profit, charged at the closing of the investment, after the rest of the commissions are paid.