- Apply

Until - Aug 5

- Minimum

amount - Price Per

Share - Current

Valuation

Invest in an AI-powered platform for fast and accurate diagnoses.

Important disclosure

*We are finalizing the price and valuation terms of the deal. The implied valuation of the deal is a preliminary estimate as it reflects the current market price of the offer.

What Is PathAI?

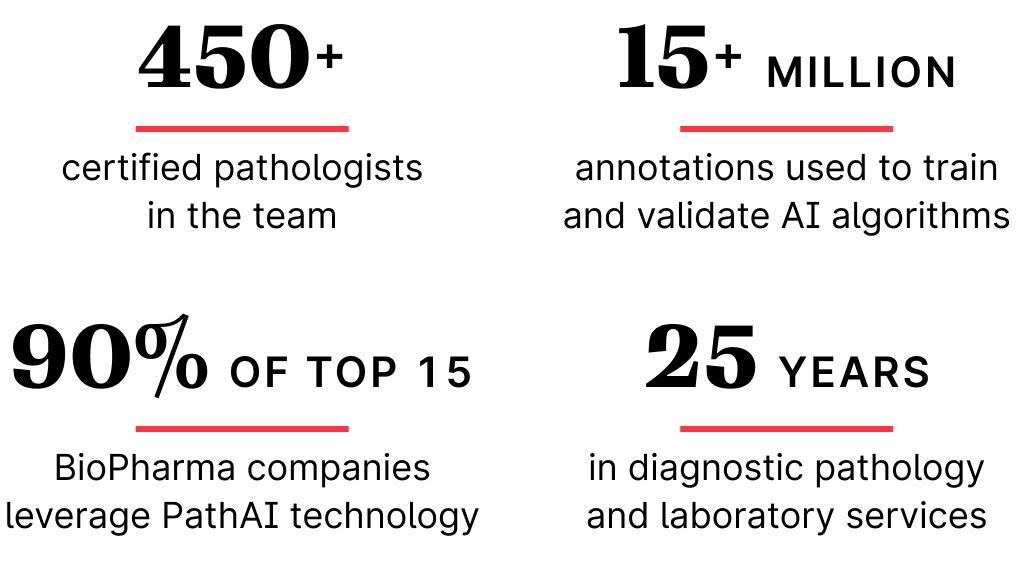

PathAI has developed a technology that helps pathologists make accurate diagnoses for patients. The company uses AI to improve the analysis of patient tissue samples and provides solutions for lab services to clinical trials and diagnostic use.

Why Invest in PathAI?

PathAI brings a new standard to diagnostics, saving countless hours

Manual pathology is highly subjective and varies between doctors, leading to different diagnoses. Being in short supply, pathologists have to spend long hours reviewing data leading to lack of interaction with patients.

New PathAI technology is changing all that, saving countless hours. It uses massive datasets to train and validate AI models. This means faster drug development, more accurate diagnosis, and getting therapies to patients faster.

Multi-million dollar, multi-year contracts with major players in the pharma industry

PathAI has long-term partnerships with companies such as Labcorp, BMS, Roche, GSK (formerly GlaxoSmithKline) and Datavant. These companies use PathAI's platform to accelerate drug development. With recent clearance in the US and EU, the company is poised to generate revenue from hospitals using its service to improve clinical diagnoses accuracy and speed.

The potential to become a leading pharmaceutical services provider

PathAI expands its AI solutions in the pathology field and provides research services for a variety of organizations including medical device manufacturers, in-vitro diagnostic assay developers, contract research organizations, and academic medical centers. As their AI engine collects more data, there is a possibility of phasing out the need for pathologists in some cases and advancing every phase of drug and diagnostic development.

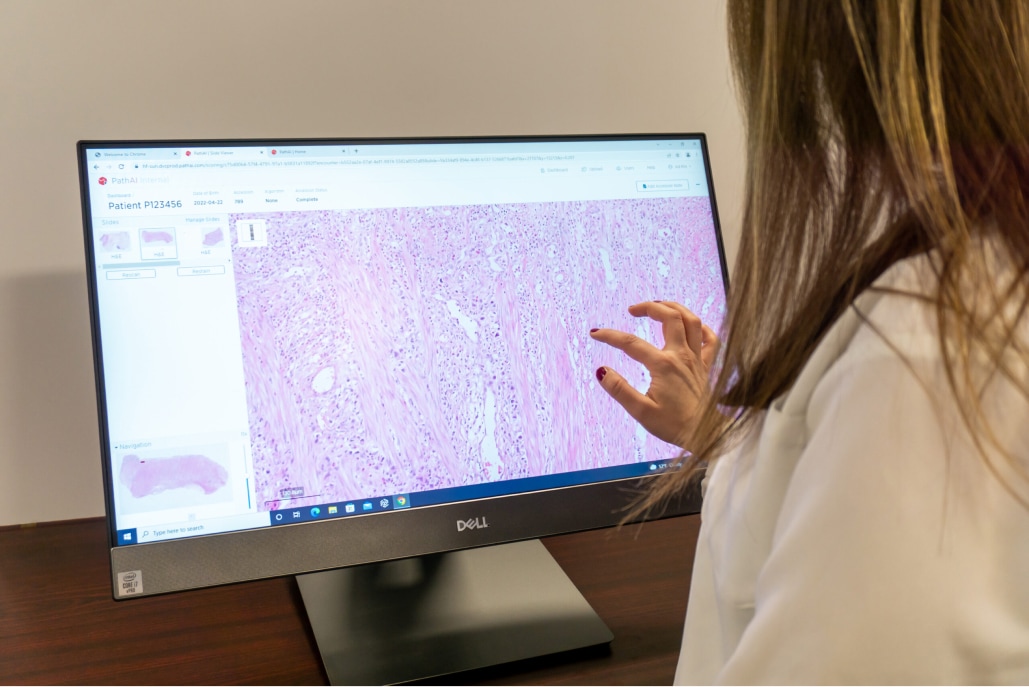

Product: AISight

AISight is the AI-powered precision pathology platform. It’s used by biopharmaceutical companies, contract researchers, laboratories, academic institutions, and physicians to support AI-driven research.

The process includes the following steps:

Using AISight, researchers can use the digital pathology platform to better understand how patient tissue samples react to certain drugs and even predict how patients may react to new drug formulations. Further, AISight enables certain pharmaceutical companies to better understand the biomarkers (elements that predict disease) that react to a drug formulation.

Market

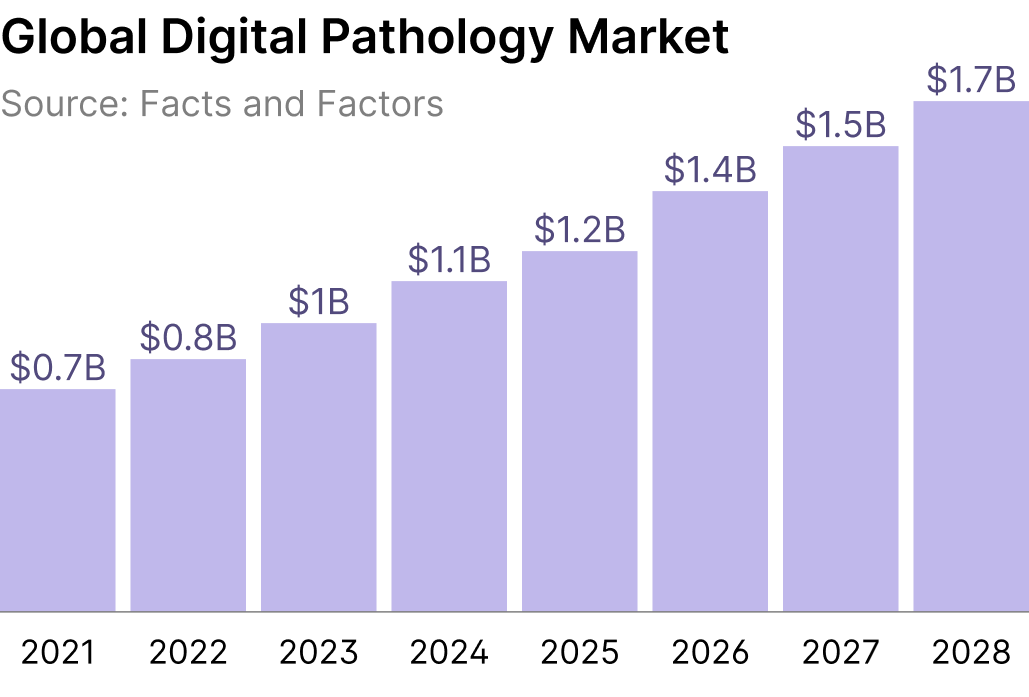

Digital pathology is a diagnosis carried out by the use of various computer technologies. Digitized specimen slide generates information that is managed by advanced computation and through virtual microscopy.

Digital pathology improves lab efficiency by lowering costs, speeding up response times, and giving subject-matter expertise. As per the WHO survey, the total number of chronic respiratory disease cases increased by 39.5% between 1990 to 2017. The rising prevalence of chronic diseases has further increased the requirement for digital pathology.

Financials

PathAI has raised a total of $255M in funding over 3 rounds from 19 investors including General Catalyst (invested in Snap, Airbnb, Livongo Health), Tiger Global Management (invested in Roblox, Meta, Square), General Atlantic (invested in CrowdStrike, Uber, Ginkgo Bioworks), Merck, Bristol Myers Squibb and others.

Risks

General risks of investing in private companies

Company-specific risks

Regulation. PathAI's business is closely dependent on governmental regulation. Any changes in regulations and policies could affect PathAI's operations and revenue.

Competition. The digital pathology market is highly competitive and has a large number of players, including Leica Biosystems, Hamamatsu Photonics, Koninklijke Philips N.V., Olympus Corporation, F. Hoffmann-La Roche Ltd. and others. Increased competition in the AI and pathology space could impact PathAI's market position and profitability.

Sources

Pathai.com/about-us/andy-beck/

Twitter.com/Path_AI/status/1613188988394676225

Twitter.com/Path_AI/status/1570759410057891844

Offering

Deal structure

Dizraptor Fund LLC is formed for the purpose of acquiring common shares of PathAI. The interests in the fund are offered to accredited investors, who, after signing a subscription agreement, become its members.

Dizraptor always seeks the optimal ownership structure for its investors. In certain cases, when direct ownership of shares is unavailable due to restrictions of a private company, Dizraptor fund will consider alternative ways of equity exposure, such as double or multiple-layer SPV partnerships or forward agreements. In this case, Dizraptor's investors will have indirect access to PathAI. In the case of a second or multiple-layer SPV, investors will have partnership units in a fund that has access to PathAI.

Fees

Management fee – 5%, paid on top of the investment amount.

Carried interest – 20% of net profit, charged at the closing of the investment, after the rest of the commissions are paid.