LESSON 4 · 4 min read

How Deals are Arranged

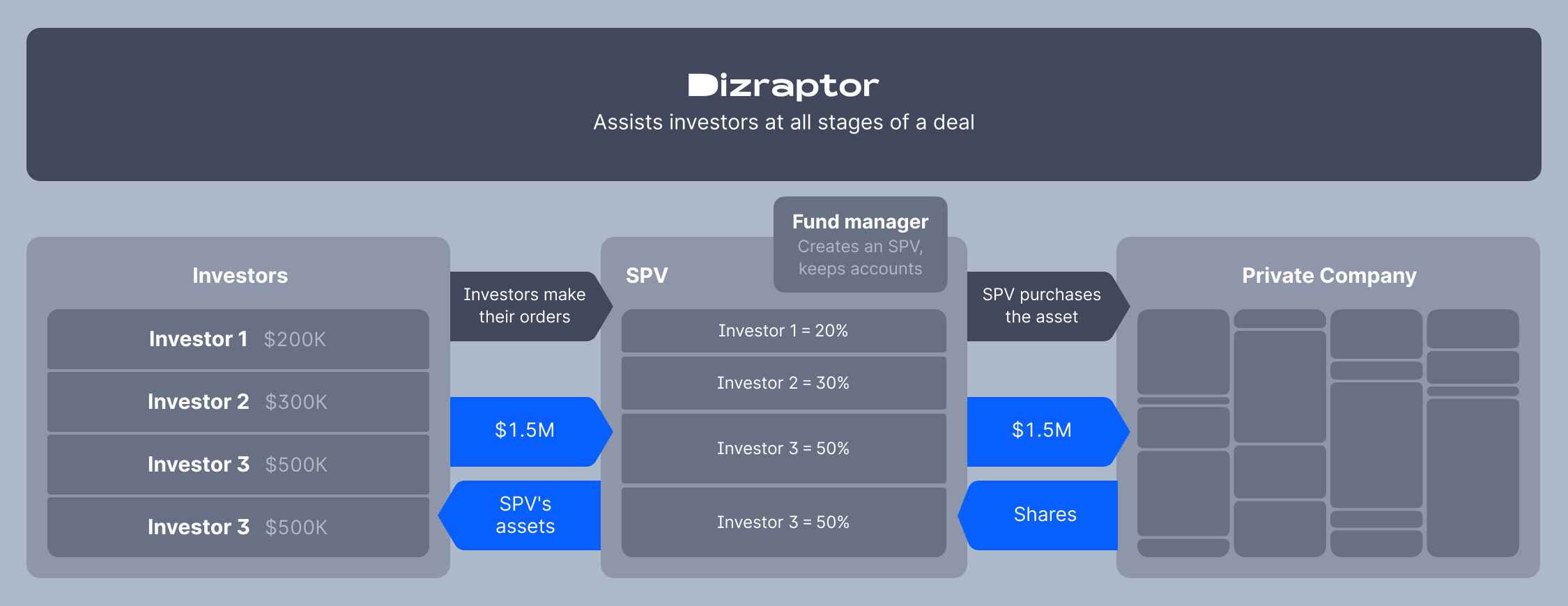

All the investments we offer are made through SPVs – special legal structures. Each SPV allows a group of investors to get exposed to a particular private company.

What SPV Means

When investing in a private company via an SPV you become a member of a fund which provides exposure to the company's shares. Each investor owns an interest in SPV’s assets proportionally to the value of the capital that he/she invested.

SPVs operating in Dizraptor ecosystem are registered under the laws of Delaware, USA. We create a separate SPV for each investment offering, invite investors to become its members and accompany them at all stages of a deal.

Fund Manager

SPV is administered by a manager, who takes care of SPVs day-to-day business operations, legal and accounting issues.

The manager seeks investment adviser’s¹ analysis of the private equity market to find a potential target – stocks. He then initiates the process of SPV creation, facilitates negotiations with counterparties on prices and deal’s size.

The manager also gets a tax number, opens a bank account, creates documents to bring in investors, ensures compliance with KYC procedures, keeps accounts and manages workflow. In these activities the manager is supported by an independent fund administrator, external legal counsel and other consultants and advisers.

Fund Administrator

Each SPV operation is overseen by an independent administrator who prepares reports on the fund's performance, conducts AML checks, assists the fund in performing any necessary additional due diligence and inquiries for U.S., etc.

Investors

Only accredited investors may become members of an SPV. To qualify, you must meet one of the criteria: your annual income for each of the prior two years should exceed $200,000 ($300,000 for joint income), your net worth should be at least $1M (excluding primary residence) or you should hold at least one license of FINRA’s Series 7, 65 or 82.

Investors sign a subscription agreement with an SPV and transfer funds to its bank account. When all investors transfer their funds, the manager proceeds with signing a purchase agreement with the sellers of private equities and transfers the purchase price to them.

Private Equity

After the transaction, the balance of each SPV contains shares of a private company or a stake in a fund that owns the shares of the company. Each investor owns an interest in SPV’s assets proportionally to the value of the invested capital.

We always seek the optimal ownership structure for our investors. In certain cases, when direct ownership of shares is unavailable due to restrictions of a private company, we consider alternative ways of equity exposure, such as double or multiple-layer SPV partnerships or forward agreements. In this case, investors get indirect access to the company. In the case of a second or multiple-layer SPV, investors have partnership units in a fund that has access to the company.