LESSON 2 · 10 min read

How Pre-IPO Investments Work

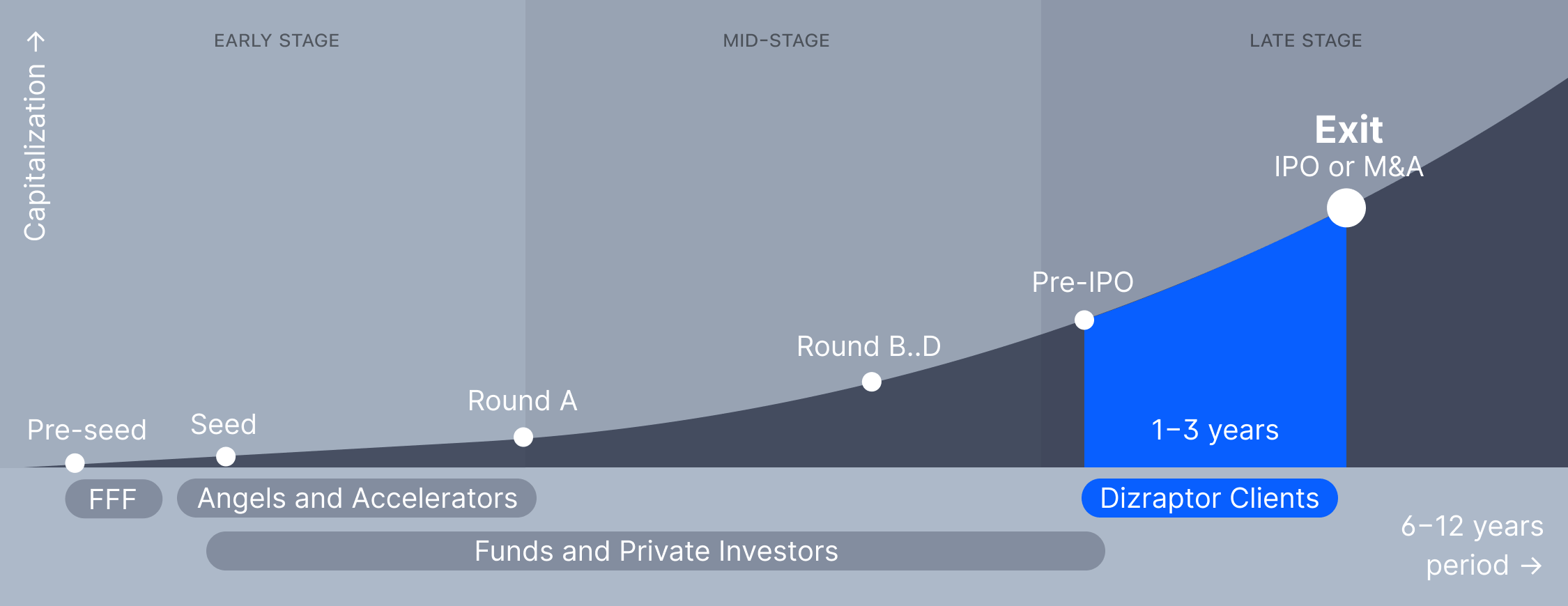

Most often we offer investments in late-stage companies prior to their listing on a stock exchange (pre-IPO). But before we delve into how to invest through Dizraptor, here’s our explanation of how investments in private companies actually work.

Valuation

Let's start with the main thing. How is a company valued? The value of a company, equals the share price multiplied by the number of shares. Valuation growth means profit for everyone: founders, employees with stock options, early-stage investors and us – those who invest at later stages (pre-IPO).

The growth of a company, which is quantified by the growth of its valuation, is a long process that takes years. The most successful companies grow fast, constantly accelerating, but they all go through several stages: early, mid- and late. Let’s explore each.

Early Stage

Seed, Pre-Seed, pitch, accelerators, business angels

The prime stage is the search for an idea and its sale to the first investors. Investors “seed” the money: they invest it in many startups hoping that a few of them will “take off” and cover the losses from the others that have failed. The first stage of investment is usually called “Seed” or “Pre-Seed”.

At this stage, the company still has only an idea, but no product. So it has to convince every investor that the idea will work: make a pitch. Even if the idea seems far-fetched, after a short and convincing story, the investor has to believe and want to invest.

But money is not everything. Connections and experience are what startups lack the most. Accelerators (intensive training programs to help new businesses get established) and business angels (private investors willing to share their experience) can help here.

Accelerators select worthwhile ideas, provide initial funding, help set up processes and launch the product in exchange for a share in a startup. There are now about 7,000 business incubators in the world, the largest of which are located in the U.S.

Startups that eventually turn out to be successful do not always manage to get into an accelerator. Many don't get money at the first try, so founders look for any source of investment. At the very beginning, the list of available investors may consist of just three classic FFF: Friends, Family, and Fools.

The result of the first stage is getting initial, the so-called “seed” investments.

Mid-Stage

Investment Funds, Rounds

A startup has already received its first investments, but it requires more money to develop. To get it, the company goes through investment rounds: it searches for investors (or investors come on their own) and raises the required sum. Usually startups associate funding rounds with an important milestone in their development.

At this stage, investment funds get involved. Funds vary by the industries they support (tech, biotech, AI, robotics), by the capital they manage and by the startup stages they specialize in when investing (well-established, mid-stage, early stage).

Every investment round means more money, issuance of shares to this round’s investors and a new valuation for the company. Rounds are denoted by letters: A, B, C, D, and so on. The rights of investors in each round may differ, but in general it is always the right to a stake in the company and the option to sell shares to make a profit.

The development of each company is individual: you can only say roughly what happens from round to round, taking as a basis a conventional “average” company.

Series A – early growth

By series A stage, the company already has a prototype and the first customers (as a result of pre-Seed and Seed rounds). Now it organizes production, improves the first versions of its product, brings it to market and tests unit economics.

Series В – scaling stage

If the previous stages served to prove the company’s viability, Series B round sets bigger, even more ambitious goals – scaling, expansion of production and sales, capturing new markets.

Series С...F – maturity stage

At this stage, a company captures a larger market share, develops new products and acquires other startups. It is already a full-fledged business that generates stable revenue streams.

There are no predetermined funding rounds a company must do. There is no fixed amount of time that must pass between rounds – every company decides for itself. Whether an investor will come on his own or the company will have to seek venture funding, how many investors will be in the next round and on what terms it will trade its equity – everything is individual.

There are no regulatory authorities on the secondary market that oblige a private company to disclose financial statements four times a year, the way public companies do (balance sheet, profit and loss statement, cash flow statement). Here investors want to profit as they wait for an IPO, companies want to get big but non-toxic money, bring their product to market, capture a portion of it or tailor it to meet their needs, then go public or remain a private company.

The growing value indicates that a company is on the right track. As it progresses from one funding round to another, its valuation becomes more accurate. Gradually the public gets to know more and more information about its business: revenue numbers, customer base, growth rates. Provided, of course, founders and management want to disclose these financials.

Late Stage

Pre-IPO

A company’s growth usually culminates in an IPO, the process of offering corporate shares to the public for the first time. When a company goes public, its investors in all previous funding rounds get an opportunity to cash out.

However, today companies remain private longer: it now takes 10-12 years from the startup inception to the IPO (it used to be 4-6 years). Large investors have long-term money and are ready to wait to profit more, while small and midsize investors who are used to buying stocks after IPO don’t have the opportunity to make money using the same instruments.

Nowadays more and more people see the results of investments at the pre-IPO stage and feel ready to invest in private companies, although 5-10 years ago they invested only in publicly traded stocks. The private market gradually ceases to be a) a gray area with muddled rules, b) a playground exclusive for large investors.

The market is gradually embracing the concept of investments in private companies even if you have a small amount of money. We at Dizraptor are pushing the market toward this trend: we are looking for ways to let midsize and small investors profit from investments in private stocks, and make this process as user-friendly as possible.

IPO

Exit, Underwriters, Listing, Direct Listing

Most private companies aspire to do an IPO. Investors in previous rounds see IPO as an opportunity to exit, while a company looks to get a fair valuation and solid clients that prefer to work with public companies (it’s easier to evaluate their product and business condition, openness plays a vital role here).

When a company decides to go public, it employs underwriters – investment banks responsible for administering a public offering, and files its prospectus with the SEC. The company prepares documentation and lists on a stock exchange. After IPO (Initial Public Offering), the company’s stocks are publicly traded and anyone can easily buy them.

However, if a company intends to do an IPO, it doesn’t necessarily need to employ investment banks. Some (like Spotify, Slack) do their own listing (direct listing). In this case there is no way to buy stocks right before IPO, and those investors who bought shares earlier, at the pre-IPO stage, hold an advantage.

M&A

One way to exit is to go the way of Mergers & Acquisitions. In this case a larger company acquires the other company’s shares. If a company is acquired with a premium – at a higher price than it was valued before, investors will profit. The later the funding rounds, the lower the risk level for investors.

Negative Scenario

When investing at the seed stage, investors believe that only a few companies from their list will take off. The rest of them will go bankrupt, and investors take this risk into account. The closer a startup to an IPO, the more stable its operations, the lower risks it will go bankrupt. However, one cannot rule out such risk.

In Brief

Hundreds of new companies emerge every day. Many of them go bankrupt, few of them will grow into unicorns (privately held companies valued at over $1B). Picking the right time is of utmost importance to investor. In our opinion, late-stage rounds (pre-IPO) are one of the best such moments.

We at Dizraptor mostly offer investments in pre-IPOs because we believe this is where the opportunity to make money is right now.

We ourselves invest in companies that we select for our platform because we see an opportunity in profiting within an investment horizon of a few years. Most of these companies develop technologies that transform the world creating new markets around them. We are also passionate about investing in private companies because they create novel things capable of disrupting our daily life.

Renting an apartment from Airbnb, taking a course through Coursera, buying Lemonade insurance or eating a plant-based burger from Impossible Foods – all this has gradually become part of our daily routine. And investments in private companies are no longer something abstract, they too have become a reality now.