Developer of MetaMask wallet and essential infrastructural elements of the Ethereum network. Invest in the future of the digital economy!

Important disclosure

*We are finalizing the price and valuation terms of the deal. The implied valuation of the deal is a preliminary estimate as it reflects the current market price of the offer.

What Is ConsenSys?

ConsenSys is the leading blockchain technology company founded by Ethereum co-founder Joseph Lubin. The company develops key infrastructure elements of the Ethereum network. One of its most famous products is MetaMask – the most popular cryptocurrency wallet with 80% market share and more than 30 million monthly users.

ConsenSys product overview

MetaMask is a crypto wallet & gateway to blockchain apps. A crypto wallet is crucial for participating in the crypto ecosystem, as it is the main connection point between users and other apps or users. MetaMask made the wallet more accessible by offering it as a browser extension, allowing users to connect to decentralized apps and easily transact without needing to use native software. MetaMask's swaps feature enables users to exchange cryptocurrencies without sending them to an exchange first.

Infura is a blockchain development suite that provides quick and reliable access to the Ethereum and IPFS networks. It is used by over 430,000 developers and recently topped $1T in annualized transaction volumes.

Quorum is an open source blockchain platform for business.

Truffle provides a framework for smart contract development. It is used and trusted by Microsoft, Ernst & Young, Airbus, General Dynamics, Amazon, J.P. Morgan and others.

Codefi is a blockchain application suite for next-generation commerce and finance. More than 100,000 developers use its managed infrastructure and more than 10 billion transactions are executed on blockchains built with Codefi.

Diligence provides smart contract audit and security service. More than 100 blockchain companies are protected by Diligence, including Aave, 0x, OmiseGO, with more than 200+ issues discovered and 10,000+ analyses available per month.

Why Invest in ConsenSys?

ConsenSys is a major player in the blockchain industry, leveraging the power of Ethereum, the largest programmable blockchain in the world. The company has more than 2,000 global customers and partners and develops essential infrastructural elements of the Ethereum network, including MetaMask's Web3 Onramp, Truffle's developer suite, and PegaSys' mainnet client. ConsenSys has incubated over 50 successful blockchain projects, including Kaleido's Blockchain-as-a-Service, and Ethereum network essentials like Infura and Alethio.

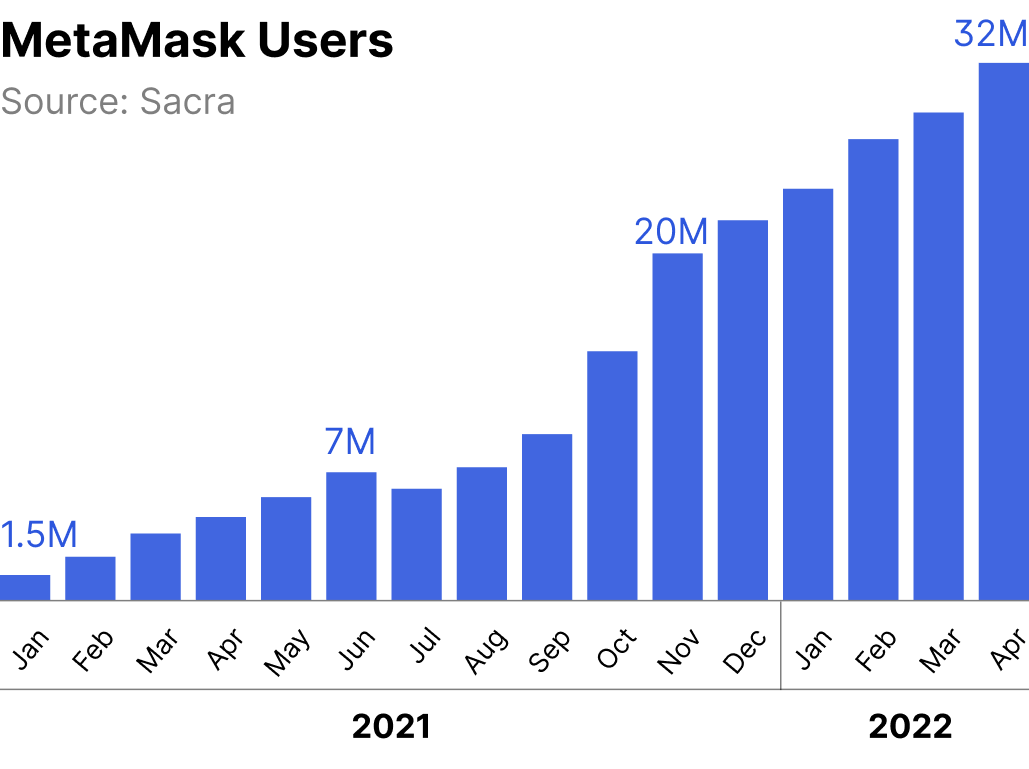

High Adoption Rates. ConsenSys' products have seen a dramatic increase in adoption rates. MetaMask, the company's most popular product, topped 30 million monthly active users in January 2022.

Leader in Enterprise Ethereum. ConsenSys was a central figure in the establishment of the Enterprise Ethereum Alliance (EEA), which has developed global standards for business applications of Ethereum technology.

EEA has over 500 members, including global business leaders such as Accenture, CME Group, Deloitte, Ernst & Young, Intel, banks like J.P. Morgan, Microsoft, Pfizer, law firms like Schulte Roth & Zabel LLP, T-Mobile, and Wipro.

Trusted by the World’s Leading Organizations

Investments from Tech Giants. During the last funding round in March 2022, Microsoft, SoftBank, and Singapore's Temasek joined as new investors in ConsenSys. Microsoft's involvement highlights growing interest from the world's largest tech firms in Web3.

Attractive risk-reward opportunity. ConsenSys shares are currently available on the secondary market for $45 per share, which corresponds to a $2.3B valuation. This presents an excellent opportunity for potential investors as it represents a 70% discount compared to the company's last financing round in March 2022.

Market

The potential market of blockchain technology is huge. The major driving factors include extensive use of blockchain solutions in banking and cybersecurity; high adoption of blockchain solutions for payment, smart contracts, and digital identities; rising government initiatives.

Financials

ConsenSys currently generates most of its revenue from MetaMask's swap fees, which are charged to users when they exchange tokens using their MetaMask wallet (0.875% per transaction). These fees increased by 2,300% in 2021, reaching $44M in December from $1.8M in January. As of March 2022, MetaMask is generating around $21M in monthly revenue, equivalent to $252M annually.

Infura, on the other hand, charges between $40 and $50 per month for every 200,000 requests, depending on the pricing tier. During Ethereum's boom phase in 2017, Infura was reportedly handling about 13 billion code requests per day, which equates to approximately $2.9M in monthly revenue, assuming a blended monthly rate of $45. Considering that daily transactions on Ethereum have increased by around 83% since 2017, Infura's revenue could be approximately $5.3M per month or $64M annually if we assume a similar increase in code requests.

ConsenSys has raised a total of $725M from well-known institutional investors such as Coinbase Ventures (invested in OpenSea, Animoca Brands), Temasek (invested in Nio, Roblox, Airbnb), Third Point Ventures (invested in Rivian, Enphase Energy), Microsoft, BlackRock, J.P. Morgan and others.

Its latest funding round in February 2022 valued the company at $7B, the price per share was $140.06. Joseph Lubin, founder and CEO of ConsenSys, said he wants the company to be “able to rapidly capitalize at scale on fundamental new constructs that emerge, such as developer tooling, tokenization, token launches, wallets, security audits, DeFi (1.0, 2.0 and beyond), NFTs, bridges, Layer-2 scaling, DAOs, and more.” The funds will also go toward hiring 600 more employees.

Summary

Investing in ConsenSys means investing in the future of blockchain and Web3 technology. As a leader in the industry, ConsenSys is well-positioned for growth and continued success. With high adoption rates, key infrastructure development, and investment from major tech firms, ConsenSys is a smart investment for anyone looking to be a part of the blockchain revolution.

Risks

General risks of investing in private companies

Company-specific risks

Rising competition. ConsenSys faces increasing competition from several players, including Coinbase Wallet, Paxos, Solana, Cardano, Fireblocks, Alchemy, Securitize, BlockApps and others. The rising competition could adversely affect the results of operations.

ConsenSys is exposed to the crypto market. If this market grows slower than anticipated, the business results of ConsenSys will be negatively affected.

Sources

Truffle Suite website, Feb 2023

Software Firm ConsenSys Closes $450M Series D to Further Web3 Developments, PYMNTS, Mar 2022

MetaMask parent company ConsenSys raises Series D at $7B valuation, TechCrunch, Mar 2022

MetaMask: Weekly Protocol Revenues Soar By 234% To $9 Million, Vauld Insights, Mar 2022

ConsenSys analysis, Sacra, Jun 2022

Offering

Deal structure

Dizraptor Fund 1025 LLC was formed for the purpose of acquiring common shares of ConsenSys. The interests in the fund are offered to accredited investors, who, after signing a subscription agreement, become its members.

Dizraptor always seeks the optimal ownership structure for its investors. In certain cases, when direct ownership of shares is unavailable due to restrictions of a private company, Dizraptor fund will consider alternative ways of equity exposure, such as double or multiple-layer SPV partnerships or forward agreements. In this case, Dizraptor's investors will have indirect access to ConsenSys. In the case of a second or multiple-layer SPV, investors will have partnership units in a fund that has access to ConsenSys.

View SPV’s Documents

Limited Liability Company Agreement (pdf)

Confidential Private Placement Memorandum (pdf)

Subscription Agreement & Privacy Notice (pdf)

Investment Management Agreement (pdf)

Fees

Management fee – 5%, paid on top of the investment amount.

Carried interest – 20% of net profit, charged at the closing of the investment, after the rest of the commissions are paid.