- Apply

Until - Sep 2

- Minimum

amount - Price Per

Share - Current

Valuation

Canva simplifies сreating visuals for everyone with easy-to-use tools and templates. Invest in the platform with 100M+ users!

Important disclosure

*We are finalizing the price and valuation terms of the deal. The implied valuation of the deal is a preliminary estimate as it reflects the current market price of the offer.

What Is Canva?

Canva is a platform where everyone from consumers to Fortune 500s can create their graphic designs, presentations, and videos at speed and scale. Its drag-and-drop tools make it simple to create professional-looking graphics in minutes. Canva offers creators templates, a user-friendly interface, and collaboration features.

Launched in 2012, Canva has quickly become a popular choice among creators and marketers worldwide. The platform makes it easy to customize designs with branding elements like logos, fonts, and colors. Canva’s designs are also optimized for social media and can be quickly shared across all the major social networks.

Why Invest in Canva?

Canva has found its niche to compete with major players

Adobe has established itself as a dominant player in the market for professional design software. And Canva positions its product as the premier solution for non-professional users, often without technical skills or advanced software. The company's focus is on creating high-quality designs with as little friction as possible.

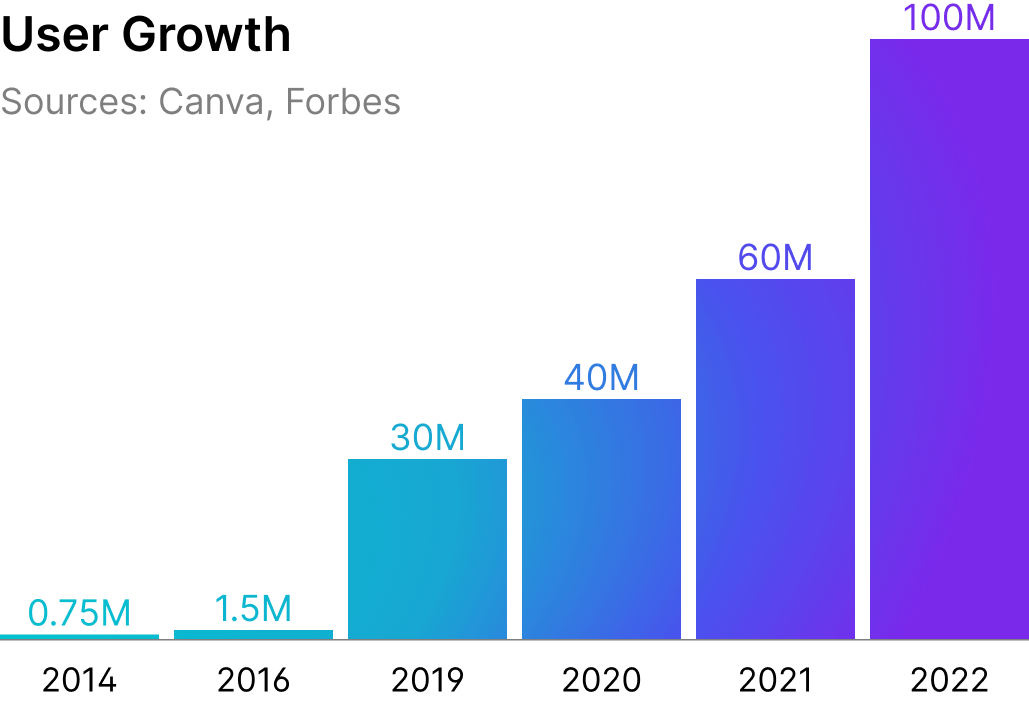

Tremendous and continuing growth in recent years

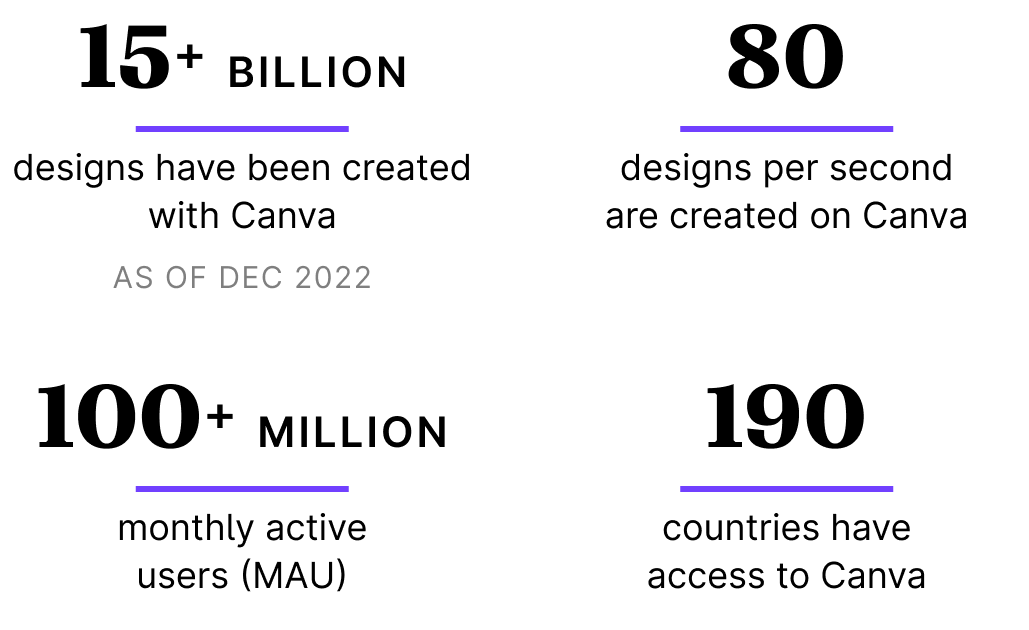

As of the end of 2022, Canva had over 100 million monthly active users in 190 countries. In April 2022 the company also reported having 5 million Pro customers. The Canva Pro is for individual users and is priced at $119.99 per year or $12.99 per month. For teams of two or more people, the company offers Canva for Teams at a cost of $149.9 per year or $14.99 per month for the first five users.

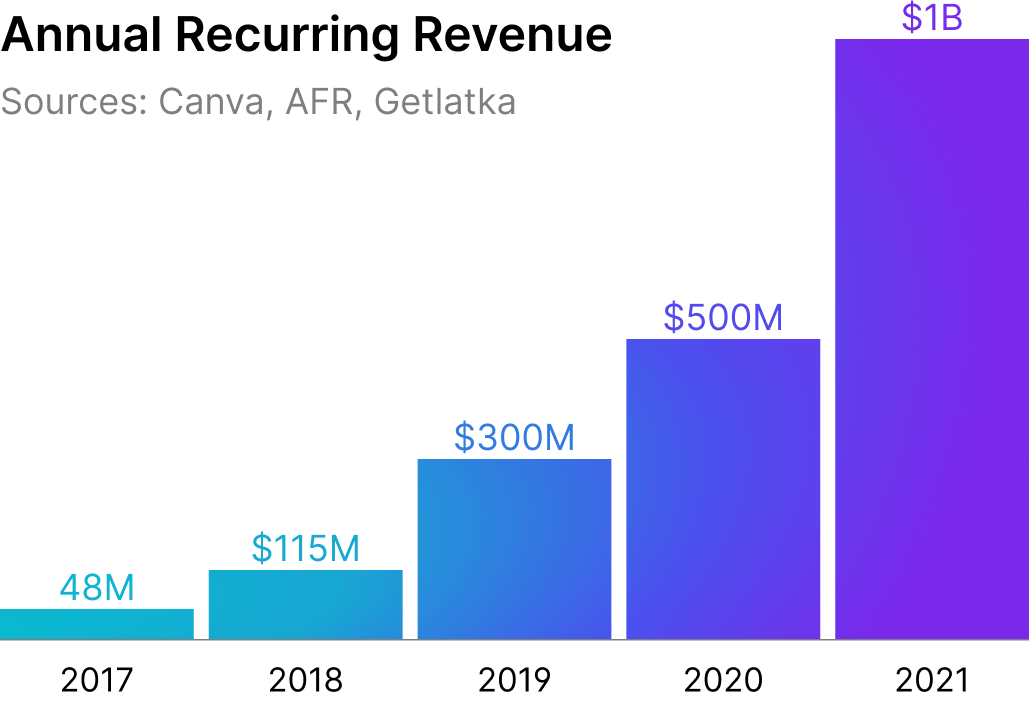

Canva has been experiencing tremendous revenue growth, with YoY growth of over 100%. A significant portion of this revenue is recurring subscription revenue, demonstrating a strong and consistent revenue stream.

Profitability

Canva has demonstrated strong financial performance by generating positive cash flows from 2017 to 2022 and is known to maintain a high level of cash efficiency. This solid financial performance is an indication of the company's potential for continued growth and success. In the current high interest rate environment it is also important to sustain sufficient cash levels as it becomes more expensive to raise capital and service debt.

Robust market and customer base

Around 800,000 teams pay for a Canva subscription, and these teams work for Salesforce, HubSpot, Zoom, Marriott International and others. More than 85% of the Fortune 500 companies use Canva.

The creator economy market is projected to reach $104B in 2022. A large portion of this market is made up of amateur designers, with over 50 million creators. Among these, the graphic design market is estimated to be $43B.

Scalable business model for further expansion

Canva operates using a freemium business model that offers both a free version and paid tiers. The free version has limitations on the number of templates available, cloud storage capacity, scheduling social campaigns across multiple platforms, and advanced editing functionality.

This allows Canva to attract a large number of users, many of whom will then upgrade to paid plans. The company has been expanding its presence in international markets. With its ability to scale up its user base and revenue, Canva's business model is considered to be scalable.

Solid recognition

Canva ranked #10 on the world’s most innovative companies list and #1 in the design category for 2022. It also appeared in CNBC Disruptor 50 2022 – the list of private fast-growing and innovative companies. According to G2 and Capterra, Canva is recognised as a market leader for ease of use, return on investment and customer satisfaction.

Summary

Canva has reached 100M+ monthly active users and $1B+ in revenues in a short period of time, while maintaining profitability and focus on product development. Canva has been steadily building a sales team and has gained a foothold in the Fortune 500 companies, in addition to targeting a $40B market that is expected to continue growing. Canva is poised to remain a formidable player in the creative software industry and presents a compelling investment opportunity.

Risks

General risks of investing in private companies

Sources

Canva User and Company Stats as of 2022, MK's Guide, Dec 2022

19 Essential Canva Statistics You Need To Know in 2023, The Social Shepherd, Jan 2023

Canva Named to Fast Company’s World’s Most Innovative Companies List, Canva website, Mar 2022

Canva hits 100M monthly active users - Growth, Digital Nation Australia, Oct 2022

Young Rich 2019: Is Canva really worth $4.7 billion?, The Australian Financial Review, Oct 2019

How Much Is Canva Worth Now? WebsiteBuilderInsider, Sep 2022

Report: Canva Business Breakdown & Founding Story, Contrary Research, Sep 2022

Offering

Deal structure

Dizraptor Fund LLC is formed for the purpose of acquiring common shares of Canva. The interests in the fund are offered to accredited investors, who, after signing a subscription agreement, become its members.

Dizraptor always seeks the optimal ownership structure for its investors. In certain cases, when direct ownership of shares is unavailable due to restrictions of a private company, Dizraptor fund will consider alternative ways of equity exposure, such as double or multiple-layer SPV partnerships or forward agreements. In this case, Dizraptor's investors will have indirect access to Canva.

Fees

Fee on management – 5%, paid on top of the investment amount.

Carried interest – 20% of net profit. Charged at the closing of investment, after the rest of the commissions are paid.