- Apply

Until - Sep 2

- Minimum

amount - Price Per

Share - Current

Valuation

Work video calls, chatting with friends, game streams and file sharing – all in one convenient app. Get in at 36% off!

Important disclosure

*We are finalizing the price and valuation terms of the deal. The implied valuation of the deal is a preliminary estimate as it reflects the current market price of the offer.

What Is Discord?

Discord is a communications app that lets users share files, voice, video, and text chat. It has over 150 million active users as of 2021.

On the platform, users can create and join different communities called “servers.” Aimed at gamers, Discord is also used in online education, remote work, trading and entertainment.

With 6.7 million active servers as of 2021, Discord is considered as a potential competitor for enterprise communication platforms such as Slack and Microsoft Teams.

Why Invest in Discord?

Rapid sustainable growth

Discord has seen a significant increase in monthly active users over the past 5 years, reaching 150 million as of 2022 – equivalent to half the population of the entire United States. This growth has also translated into a decrease in the market share of established messaging apps such as Meta's Messenger and WhatsApp.

Interestingly, 78% of Discord users indicate that they primarily use the platform for non-gaming activities or for a combination of gaming and non-gaming activities.

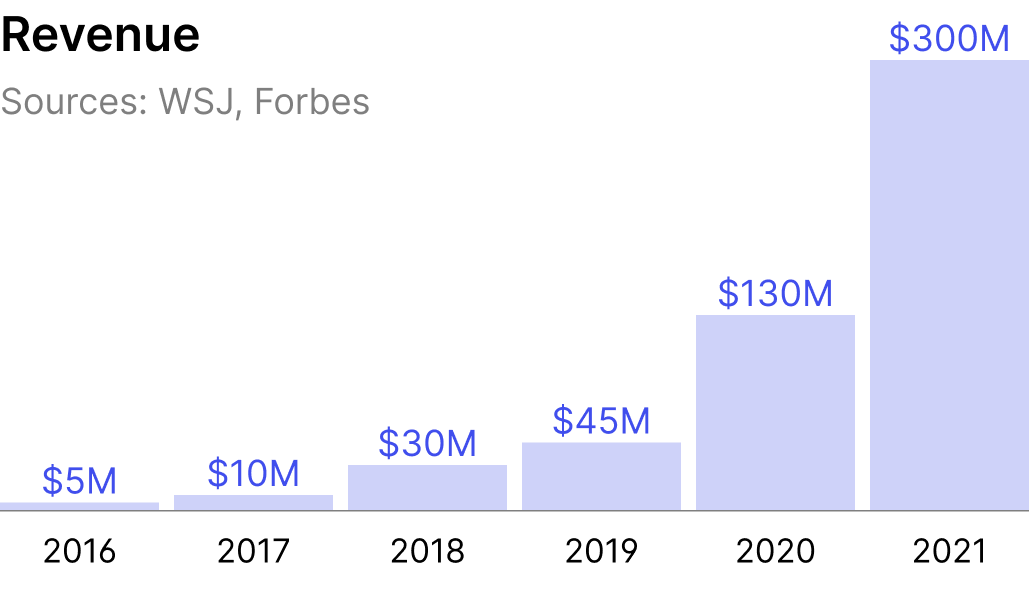

Rapidly growing revenue

Discord's revenue comes mainly from its Nitro subscription service, which offers enhanced features for users, and has seen strong growth in recent years. The company has announced plans to monetize through advertising, which could provide a significant new source of revenue. Other paid services include game distribution and server boosting.

The market potential is still big

Despite the significant growth in participation in online communities, the penetration of tools like Discord remains low. In 2010, the Internet had a population of approximately 2 billion people, with only 17% of them participating in online communities, equating to 340 million community members. There are now 5 billion people online, with 76% of them participating in an online community, representing 3.8 billion community members. 1.8 billion of them are using Facebook groups. Thus, there is a significant opportunity for growth in the market for communication platforms like Discord.

Discord is capitalizing on the trend of niche communities on social networks. As more people join, they seek out small, specialized communities that fit their interests. Discord may capture a significant share of the social network market.

Discount

The current secondary market price is around $9.7B valuation and provides a 36% discount to the last round. Back in 2021 Discord rejected a $12B purchase offer from Microsoft, focusing on its own growth and the potential entry into the stock market at some point.

Opportunities ahead

While the company has a revenue model that relies on a combination of subscriptions and commissions, Discord is one of the most under-monetized consumer-facing services per user. The company is investigating new strategies, experimenting with different subscription models, and exploring microtransactions and payment infrastructure to increase monetization.

Risks

General risks of investing in private companies

Sources

20 Discord Statistics, Facts and Trends for 2023, Cloudwards, Aug 2022

Report: Discord Business Breakdown & Founding Story, Contrary Research, Sep 2022

Discord Revenue and Usage Statistics (2023), Business of Apps, Jan 2023

What Is Everybody Doing on Discord? WSJ, Mar 2021

Discord has surpassed 250 million registered users, TechSpot, May 2019

Global Social Media Market Estimated To Grow At 39% Rate, EIN Presswire, Oct 2022

Offering

Deal structure

Dizraptor Fund LLC is formed for the purpose of acquiring common shares of Discord. The interests in the fund are offered to accredited investors, who, after signing a subscription agreement, become its members.

Dizraptor always seeks the optimal ownership structure for its investors. In certain cases, when direct ownership of shares is unavailable due to restrictions of a private company, Dizraptor fund will consider alternative ways of equity exposure, such as double or multiple-layer SPV partnerships or forward agreements. In this case, Dizraptor's investors will have indirect access to Discord.

Fees

Fee on management – 5%, paid on top of the investment amount.

Carried interest – 20% of net profit. Charged at the closing of investment, after the rest of the commissions are paid.